Analysis by Football Benchmark

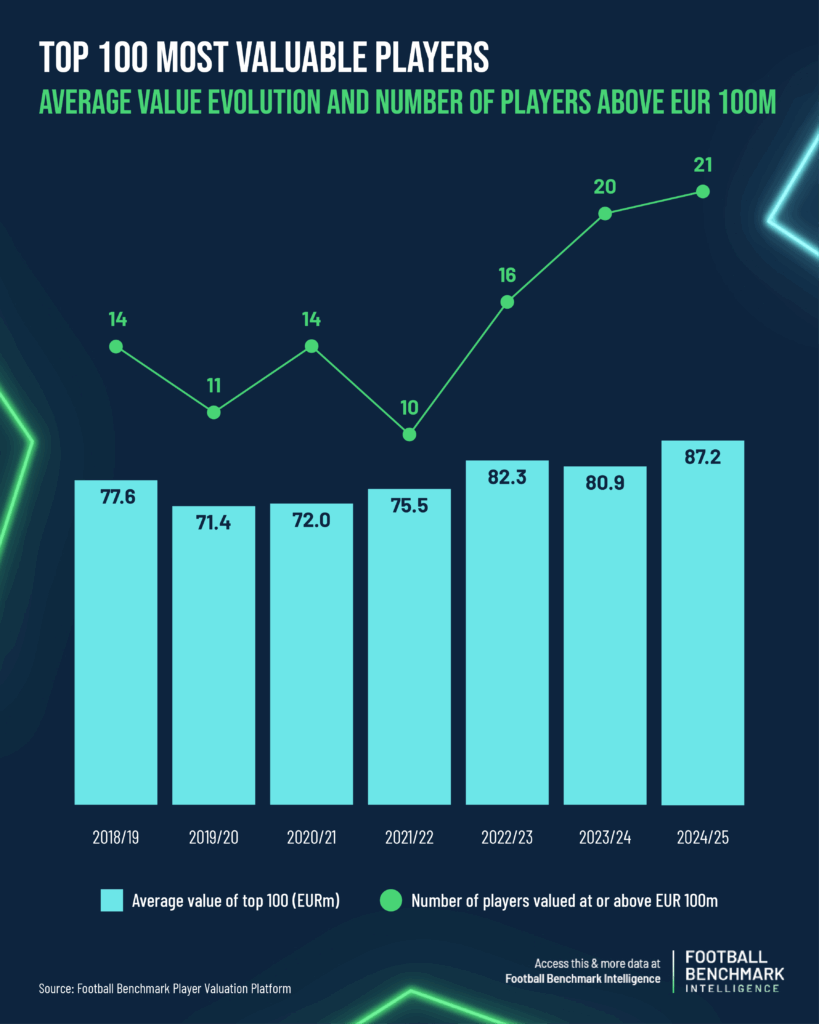

According to the latest update from Football Benchmark’s Player Valuation Platform, a record 21 players are now valued at over €100 million. Alongside this, the average value of the top 100 players has climbed since the Platform was launched (€77.6 million in 2019), hitting €87.2 million in June 2025.

From Lamine Yamal’s remarkable rise to the top of the overall rankings to Hugo Ekitike’s valuation leap since February, the data reflects not just who’s most valuable, but how the profile of value in football is evolving. Younger players, strategic squad planning, and a greater emphasis on financial discipline are all influencing how clubs build and protect their top assets.

Football Benchmark’s valuation model estimates a player’s market value based on the economic value of their contract. Factors such as contract length, age, performance and international experience all play a key role in the final figure.

This piece explores the data behind the latest valuation update: who’s at the top, who’s rising fastest, where youth is creating value, and how those inside and outside the “Big Five” leagues are faring.

“We’re seeing a reshaping of how value is distributed, not just through record numbers of €100 million players, but through the depth of high-value talent across the top 100,” said Andrea Sartori, Football Benchmark’s Founder & CEO. “Clubs are managing top players less as short-term performers and more as long-term assets, especially as top talent continues to emerge at younger ages. Valuation is now tied as much to contract strategy and squad planning as it is to on-pitch output. In today’s increasingly regulated and data-driven market, understanding true player value has become a competitive advantage in itself.”

The €100 million mark, while ultimately just a round number, remains a reference point. It is a threshold that only a handful of transfers in history have ever surpassed and serves as a strong indicator of elite value in today’s game.

Since the 2018/19 season, the number of players valued at or above €100 million has climbed from 14 to 21. Over the same period, the average value of the top 100 players has reached €87.2 million in July 2025, up from €77.6 million six years ago.

A snapshot of the most valuable players across the market

Lamine Yamal now tops the rankings with a market value of €279.7 million, positioned for the first time as the most valuable player in world football. The 18-year-old has seen a sharp rise in his value since the conclusion of the January transfer window, with his recent contract extension at FC Barcelona playing a key part in the increase.

He is joined in the top five by Kylian Mbappé (€236.9m), Erling Haaland (€182.6m), Jude Bellingham (€174.5m), and Vinicius Junior (€171.5m). Across the top 10, players like Florian Wirtz (€144.1m), who recently completed a high-profile move to Liverpool, and Pedri (€131.8m), who enters the top 10 since the last update, reflect the growing market strength of younger talent. All players in the top 10 are aged 26 or under, except Federico Valverde who turned 27 this month, underlining the emphasis clubs place on youth, longevity and long-term asset value.

The most significant increases in market value among the top 100 players since the last update in February, following the conclusion of the January transfer window, are Lamine Yamal (18, +€121.75 million), Désiré Doué (20, +€50.95 million), and Hugo Ekitike (23, +€36.00 million; since transferred to Liverpool FC, valuation reflects his status at Eintracht Frankfurt as of the June 2025 update of our Player Valuation Platform). Notably, all players in the top 10 by market value increase, except for Vitinha, are 23 years old or younger.

The age profiles of these increases demonstrate that top clubs are increasingly focused on managing the timing of a player’s transition to the first team and their accelerated integration into top-level competition are now seeing meaningful valuation gains. It also appears increasingly common for players to start accumulating significant first-team minutes at a younger age, which contributes to their high valuation. For example, Yamal already has two full seasons in senior football under his belt. Other high market value players yet to turn 18, such as Konstantinos Karetsas of KRC Genk and Ayyoub Bouaddi of LOSC Lille, have done the same.

When examining the most valuable under-21 players, PSG have three players in the top five: Désiré Doué, João Neves, and Warren Zaïre-Emery. This underscores the club’s commitment to building a long-term squad. Manchester United FC are also represented by two players, Alejandro Garnacho and Kobbie Mainoo, still under contract until 2028 despite both having experienced challenging seasons in what was an overall disappointing campaign for the Red Devils.

Six of the top 10 most valuable players currently outside the top five leagues are playing in Portugal, highlighting the strength of Liga Portugal and, in particular, the consistent performance of Sporting CP, FC Porto and SL Benfica in talent development.

Sporting’s Viktor Gyökeres tops this list and is one of the most talked-about forwards in the current transfer market, with a reported move to Arsenal on the horizon (valuation reflects his status at Sporting CP as of the June 2025 update of our Player Valuation Platform). As a high-output striker in a position of increasing scarcity, his value has grown. Teammate Morten Hjulmand and FC Porto’s Rodrigo Mora also feature, with Benfica represented by António Silva.

This depth of talent is no coincidence. Benfica and Porto were both ranked among the top five clubs in our 2025 Valuation Report in terms of aggregate player trading balance over the past decade, with Benfica topping the list.

The financial strength of the “Big Five” leagues remains dominant, but the development and value creation from clubs outside these markets are increasingly integral to the global football ecosystem, with Portugal a leading hub for talent.

Understanding what’s shaping player value today

The latest valuation update reflects a market that is growing in a more structured and disciplined way, with leading clubs prioritising long-term planning over short-term moves. The real story is not runaway spending at the top, but rather how financial sustainability is driving a broader shift: youth academies are being strengthened and clubs are doubling down on identifying and onboarding exceptional talent at younger ages, often before they’ve fully broken through.

This strategy brings both opportunity and complexity. The acceleration of young players’ careers, sometimes triggered by just a few standout performances, can lead to sudden and substantial jumps in market valuation. In such a fast-paced environment, clubs need tools to make informed, consistent decisions about player value.

That’s why relying on structured, data-driven valuation models is more important than ever. Rather than chasing market hype or relying on anecdotal judgment, clubs need to understand the real economic value of each player, especially as younger talent increasingly becomes the cornerstone of sporting and financial strategy. Football Benchmark’s Player Valuation Platform is built to meet that need, offering robust insights to support better decisions across the global football ecosystem. To learn more, visit footballbenchmark.com.

By Football Benchmark

Player valuation update: The most valuable players in world football today

Analysis by Football Benchmark According to the latest update from Football Benchmark’s Player Valuation Platform, a record 21 players are now valued at over €100 million. Alongside this, the average value of the top 100 players has climbed since the Platform was launched (€77.6 million in 2019), hitting €87.2 million in June 2025. From Lamine Yamal’s remarkable rise to the top of the overall rankings to Hugo Ekitike’s valuation leap since February, the data reflects not just who’s most valuable, but how

FIFA Club World Cup 2025: Breaking down the billion-dollar prize money and its impact on clubs

Analysis by Football Benchmark With USD 1.25 billion allocated through prize money and solidarity payments, the expanded FIFA Club World Cup offers a practical example of how global competitions are influencing club revenues and shifting the financial landscape across regions and tiers of the game. While the highest earners were familiar names, the data reveals a more nuanced picture. European clubs from outside the “Big Five” leagues, as well as those with lower annual revenues globally, experienced significant financial impacts relative

THE 2025 COPPA ITALIA FINAL HIGHLIGHTS SUSTAINABILITY BEST PRACTICE

After the inaugural edition of the “Road to Zero” project in 2024, Lega Serie A, Sport e Salute, Roma Capitale and Roma Servizi per la Mobilità, with the support of UEFA, continued their commitment to sustainability during the 2024/2025 Frecciarossa Coppa Italia Final. The final hosted AC Milan and Bologna FC at the Stadio Olimpico in Rome on the 14th May 2025 and saw the implementation of several initiatives in alignment with last years’ “Road to Zero” ESG (Environmental, Social and Governance) framework. The “Road to Zero” ESG framework was

Football Clubs’ Valuation: The European Elite 2025

Analysis by Football Benchmark In the 10th edition of Football Benchmark’s Valuation Report, Real Madrid CF reaffirm status as world’s most valuable football club and become first valued over EUR 6 billion. Key Conclusions: 1) Real Madrid CF lead Football Benchmark’s Football Clubs’ Valuation: The European Elite rankings at EUR 6.3 billion, the highest Enterprise Value ever recorded. 2)Manchester City FC and Manchester United FC complete an unchanged top three, both surpassing the EUR 5 billion mark for the first time, while Aston Villa

Multi-Club Ownership in Spain: a diverse and strategic landscape

Analysis by Football Benchmark Following our recent analysis of the evolution of multi-club ownership (MCO) in Portugal, attention now turns to Spain, an increasingly attractive market for investors. Unlike Portugal, where MCO-affiliated clubs frequently operate as feeder teams, the Spanish MCO ecosystem is significantly more diverse. It features lead and feeder clubs, horizontally structured networks without clear hierarchies, and hybrid models characterised by shared ownership but limited operational integration. An attractive market for football investors Spain’s appeal to football investors, particularly MCO groups,

Attendances in Women’s Football: Strategic Drivers and Outlook

Analysis by Football Benchmark Following last week’s analysis of rising matchday attendances in men’s football, this article shifts focus to the women’s game — where recent seasons have seen promising momentum. European women’s football is gaining traction through increased media coverage, and growing commercial interest, fueling a steady rise in stadium attendances. Yet, infrastructure constraints, intensified competition for fan attention, and misaligned stakeholder priorities have hindered a more cohesive and systematic approach to growing stadium audiences. In a market where significant

Rising Crowds, Rising Opportunities: Harnessing Attendance Growth

Analysis of Football Benchmark The booming live event and experience economy is reshaping how consumers prioritise their time and spending — and football is uniquely positioned to benefit from this broader trend. Across Europe’s top leagues, stadiums are now brimming with energy and expectation, as matchday attendance surpasses pre-pandemic norms. This resurgence is more than symbolic. At a time when media rights revenues are plateauing for many clubs and commercial growth is maturing, rising attendances — coupled with a fresh wave

Investing in Portuguese football: a prime spot for Multi-ClubOwnership?

Analysis by Football Benchmark 1. Portugal boasts a strong player development ecosystem, with elite academies consistently producing high-value talent that moves to Europe’s top leagues.2. The country’s historical and linguistic ties to some areas of South America and Africa provide a competitive edge in scouting and integrating emerging talent.3. Favourable regulations, including unrestricted recruitment of non-EU players, enhance Portugal’s appeal as a key market for international talent development.4. The relatively low acquisition costs of Portuguese clubs, coupled with expected revenue growth

Stadium Business – Strategies to optimize matchday revenues

For decades, matchday revenue has been a cornerstone of football club finances, alongside broadcasting and commercial income. However, new fan engagement trends and technological advancements are challenging traditional ticketing models. Clubs must now adapt to a rapidly changing landscape where fan expectations, digital innovation, and commercial pressures require a more dynamic, data-driven approach to stadium monetization. In this article, we explore some of the strategies football clubs are implementing to maximize their matchday revenues. Defining matchday revenues Before the analysis, it is

SFS SNACK BRUSSELS – Football and Europe: rules, rights and priority

In the prestigious setting of the European Parliament, a symbolic venue for decisions that shape the future of Europe, on 26 March from 16.30 to 18.30 the SFS Snack Brussels, entitled "Football and Europe: rules, rights and priority",presents itself as a key event for debating the governance of European football. At a time of profound regulatory transformations and global challenges, this event offers a unique opportunity to bring together institutions, experts, and key industry players to outline effective strategies for