Article written by Football Benchmark

Growing professionalisation in women’s football is increasingly visible off the pitch, as clubs establish dedicated leadership structures to support the game’s long-term development. Among Europe’s leading leagues, England’s WSL has become a clear example of how this transformation is taking shape.

Most clubs now feature dedicated leadership roles for their women’s sides, with Managing Directors and CEOs responsible for overall structures. Chelsea appointed its first Women’s Football CEO in 2024, Brighton in 2023, while others have formalised positions that were previously shared within wider club hierarchies. Collectively, these developments mark a new phase of maturity, positioning the WSL as an advanced women’s league in Europe in terms of organisational design. Comparatively, in a market like Spain (despite exceptional on-pitch success recently), the landscape differs from that in England, as most clubs still lack dedicated leadership structures for their women’s football sections.

To assess the professionalising structures, this article examines the evolution of women’s football leadership across England’s WSL through three dimensions – gender, women’s football experience, and playing background – while drawing selective comparisons with Spain’s Liga F.

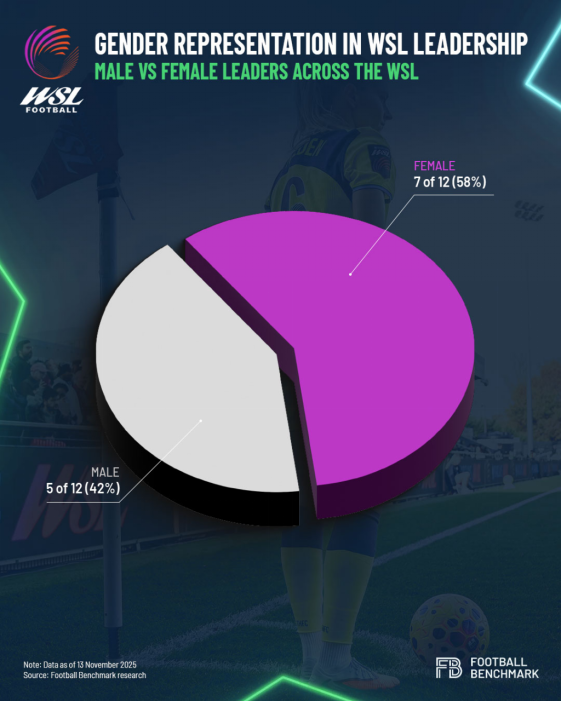

Gender representation in WSL leadership

Clubs are increasingly establishing dedicated corporate structures covering sporting, commercial and operational areas specific to the women’s game, marking a clear shift from shared oversight to defined leadership. Professionals are being recruited to focus exclusively on women’s football, although these roles remain challenging to fill given the limited pool of specialist talent and the need for both business and football expertise. But how can the profile of these leaders be described? When it comes to gender representation, the WSL’s leadership landscape reflects steady progress in increasing the number of women in senior roles.

Across the 12 WSL clubs, 7 of the senior leaders responsible for women’s football are women (58%) and 5 are men (42%). The majority of clubs now have women leading their women’s football operations, many holding the title of Managing Director or CEO. This marks a significant step in the industry, with more women now occupying visible decision-making positions at the elite level of the women’s game.

Charlotte O’Neill, Managing Director at Manchester City Women, and Maggie Murphy, Managing Director at Aston Villa Women, are among the figures leading women’s clubs. Both head their clubs’ women’s football operations and are supported by female colleagues in Directors of Women’s Football roles, reflecting not just the expanding space for women in senior decision-making across the league but also the emergence of layered female-led leadership, with women holding positions within the leadership team at technical levels as well.

At West Ham United, Karren Brady’s oversight of the women’s team while serving as Vice-Chair of the club is an example of a club where responsibilities remain shared across the organisation.

In Spain’s Liga F, the landscape is currently more male-dominated. Of the 16 senior figures leading women’s football operations, 10 are men (63%) and 6 are women (37%). While representation is improving, the structural setup explains much of this imbalance. Many Liga F clubs still lack independent leadership positions for the women’s side, meaning responsibilities are often shared with existing executives from the men’s football or business operations.

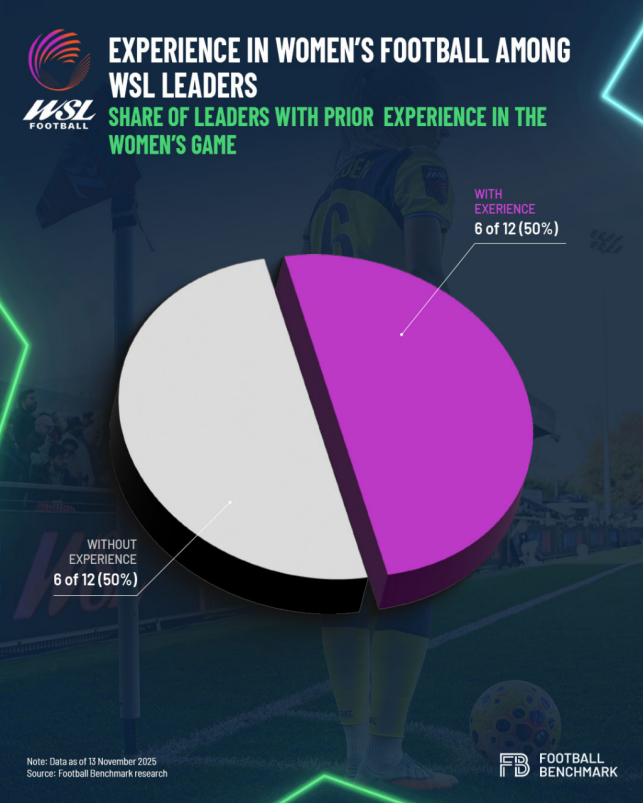

Experience within the women’s game

The professional experience of those leading women’s football operations provides another indicator of how the game is evolving off the pitch.

Half of the WSL’s senior leaders have previous experience working directly in the women’s game, while the other half come from broader football or business backgrounds. Among those with women’s football experience are leaders at Arsenal, Aston Villa, and Brighton, who have developed through varied roles within the game. At the same time, many senior figures come from wider pathways. Aki Mandhar at Chelsea and Hannah Forshaw at Everton each have taken on the roles from management positions within the football industry, but not specifically within the women’s side.

In Spain’s Liga F, of the 16 senior figures overseeing women’s football, 14 (88%) have prior experience in the women’s game and only 2 (13%) do not. However, a direct comparison with WSL profiles would be misleading, as most Liga F clubs still lack dedicated management structures for their women’s football sections. Consequently, many of these figures primarily oversee football operations and therefore tend to have predominantly technical backgrounds.

In Spain, only independent clubs currently have dedicated CEOs or General Managers for women’s football. Even at FC Barcelona, the women’s team does not operate under a standalone corporate structure, with resources and decision-making integrated within the wider organisation.

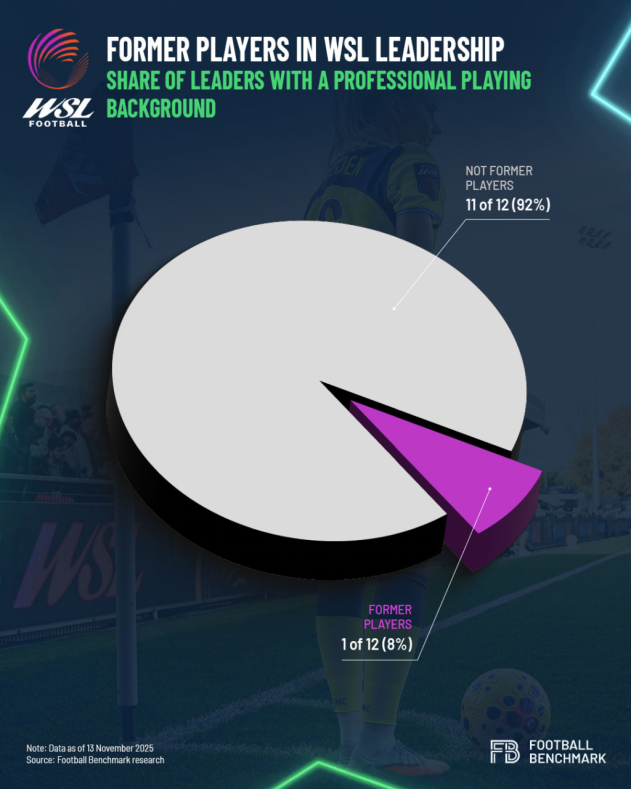

Former players in leadership roles

The presence of former players in senior roles offers another perspective on how the women’s game is shaping its leadership identity.

Only 1 of the 12 WSL leaders has a professional playing background. Clare Wheatley at Arsenal is a former player who has transitioned into senior management and, after many years within the club, has contributed to the club’s stability and continuity.

In Spain’s Liga F, 7 of the 16 senior leaders (44%) have a playing background. While this represents a higher share than in England, most of these individuals hold technical or sporting positions rather than business or executive roles. The pattern highlights two distinct approaches to leadership: Spain’s model remains rooted in football knowledge and sporting development, while the WSL is evolving through a more corporate and management-led structure.

Together, these dynamics show how both leagues and the women’s football industry more broadly are moving toward balance: combining the professional expertise needed to manage growing organisations with the lived football experience that adds authenticity and insight to leadership.

Evolving leadership for a sustainable future

The creation of defined leadership roles represents a significant step in the professionalisation of the game. In England, the WSL combines a clear majority of women in senior positions with a growing number of executives who bring specific experience in the women’s game. The move toward structured governance reflects an ambition to manage women’s football with the same rigour and accountability as the wider industry.

Spain’s Liga F is progressing along a similar path, encouraging clubs to move toward greater independence, although leadership structures remain largely integrated within broader club frameworks. Development continues, but at a different stage of maturity.

Across both leagues, the leadership profiles reflect a sector in transition, professionalising rapidly, attracting experienced operators from across football and beyond, and opening clearer career pathways for those building their expertise within the women’s game.

Football Benchmark works with clubs and investors to assess and design organisational structures, ensuring governance and leadership are aligned with market context and long-term ambitions, helping translate structural progress into sustainable success.

The rise of women’s football executives: Inside the WSL’s evolving leadership structures

Article written by Football Benchmark Growing professionalisation in women’s football is increasingly visible off the pitch, as clubs establish dedicated leadership structures to support the game’s long-term development. Among Europe’s leading leagues, England’s WSL has become a clear example of how this transformation is taking shape. Most clubs now feature dedicated leadership roles for their women’s sides, with Managing Directors and CEOs responsible for overall structures. Chelsea appointed its first Women’s Football CEO in 2024, Brighton in 2023, while others have formalised

European football M&A in 2025: fewer mega deals, broader global reach

Article written by Football Benchmark European football’s investment landscape in 2025 reflects a maturing market, with global capital continuing to flow into the game through a broader mix of strategic acquisitions, growing multi-club networks, and investment activity across all tiers of the pyramid. Between January and October 2025, Football Benchmark’s Club Transaction database recorded 76 acquisitions involving clubs across all levels of the European game, based on tracked transactions known to us and publicly available information. Of the transactions with available

BlueCo’s Strasbourg project: Investing to build a competitive force in a fragile Ligue 1

Article written by Football Bnehcmark RC Strasbourg is emerging as one of Ligue 1’s most ambitious projects under new ownership. BlueCo’s takeover in June 2023 marked a decisive turning point, placing the club within a multi-club ownership structure aimed at driving growth through targeted investment, talent integration, and shared expertise. This transformation comes against a backdrop of fragility across French football. Ligue 1 continues to face structural financial challenges, with the value of broadcasting rights plateauing and questions lingering over the league’s

Milan’s new stadium: Revenue potential, investment requirements, and the case for sharing

This article will answer the following three key questions: how much additional revenue could the new stadium generate, what level of investment will it require, and does it truly make sense for the two clubs to continue sharing a home? On 30 September 2025, the Milan City Council approved the sale of San Siro and its surrounding land to AC Milan and FC Internazionale, clearing the way for the stadium’s demolition and the construction of a new, shared home for the

Youth development in the Premier League: Analysing pathways and opportunities for young players

Article written by Football Benchmark The Premier League is recognised worldwide as the most competitive and lucrative domestic competition. Alongside its record revenues, the league and English football more broadly have accelerated their progress in youth development in recent years. England’s U21 side secured its second successive UEFA U21 EURO title this summer, while players such as Liverpool’s Rio Ngumoha and Arsenal’s Max Dowman are making first-team debuts before turning 17. At the same time, at the highest level of

Breaking into the Premier League’s “Big 6”: Are challengers changing the competitive landscape on and off the pitch?

Article written by Football Benchmark Over the past decade, the term “Big 6” has become central to discourse around the Premier League. Arsenal, Chelsea, Liverpool, Manchester City, Manchester United, and Tottenham Hotspur have been the sporting and financial powerhouses of a league that is itself the global leader in club football. These clubs have dominated domestic performance, secured the majority of Champions League places, and built global commercial brands. Yet the wider environment has shifted. The Premier League’s broadcast revenues have increased,

Who leads Europe’s clubs? CEO profiles and pathways across the “Big Five” Leagues

Modern football is shaped as much in the boardroom as on the pitch. At the centre of this transformation is the Chief Executive Officer (CEO), the figure tasked with steering clubs through the complexities of global finance, commercial growth, and sporting ambition. Once dominated by chairmen or part-time directors, club leadership has professionalised, and the CEO role has become central to how ownership vision is translated into day-to-day action and long-term strategy.Following our recent analysis of Sporting Directors, this research

Profitability in football: Lessons from Europe’s most profitable clubs

Article written by Football Benchmark European club football has enjoyed strong revenue growth over the past decades, driven by expanding competitions, internationalisation, and commercial innovation. Yet recent years have tested this trajectory. The COVID-19 pandemic disrupted operations, while ongoing shifts in the media landscape continue to put pressure on historically reliable income streams. In parallel, regulatory frameworks have increasingly prioritised financial sustainability, reshaping the operating environment for clubs across the continent. Despite rising revenues, there remains a widespread perception that football

UEFA Club Competition reforms over the years: Analysing the impact on clubs in small and medium-sized markets

Article written by Football Benchmark UEFA Club Competitions (UCC) are widely regarded as the pinnacle of club football. For most clubs, however, participation on this stage is anything but guaranteed and often celebrated as a landmark achievement. Automatic access to the UEFA Champions League (UCL) league phase is restricted to the top ten leagues by UEFA’s country coefficient. However, the remaining 45 nations, home to nearly 200 million people, are a fundamental component of European club football, providing diversity, depth,

Atlético de Madrid’s transformation: A decade of capital, competitiveness, and global reach

Article by Yossi Segal & Márton Ferencz | Football Benchmark Over the past decade, Atlético de Madrid has redefined its position in European football. On the pitch, the team has become a regular fixture in the UEFA Champions League and has consistently challenged Spain’s two giants for domestic honours. Under Diego Simeone's stewardship, Atlético has reached two Champions League finals, won La Liga in 2014 and 2021, and lifted the UEFA Europa League and Super Cup, cementing its reputation on the