For decades, matchday revenue has been a cornerstone of football club finances, alongside broadcasting and commercial income. However, new fan engagement trends and technological advancements are challenging traditional ticketing models. Clubs must now adapt to a rapidly changing landscape where fan expectations, digital innovation, and commercial pressures require a more dynamic, data-driven approach to stadium monetization. In this article, we explore some of the strategies football clubs are implementing to maximize their matchday revenues.

Defining matchday revenues

Before the analysis, it is essential to define what constitutes matchday revenues: primarily, they refer to the income generated by football clubs from hosting matches at their home venues. Revenue streams include ticket sales — general admission, season tickets, and premium seating packages — as well as earnings from hospitality services, corporate boxes, and stadium-related events such as concerts or other sporting events. These figures not only reflect fan engagement and demand but also highlight the efficiency of stadium infrastructure utilization.

Challenges in matchday income optimization

Matchday income remains a critical revenue stream for football clubs, yet it is often constrained by a variety of structural and operational challenges that prevent its full potential from being realized. These challenges include outdated stadium infrastructure, limited seating capacity, and inefficient utilization of matchday amenities. Even for larger clubs with significant commercial and broadcasting revenues, there is a constant drive to expand and modernize stadiums to unlock greater income opportunities, a need felt even more by smaller clubs that rely heavily on matchday revenue for financial sustainability.

Stadium Capacity

Stadium capacity is a critical factor limiting matchday revenue. Clubs with smaller venues or those that consistently sell out face challenges in maximizing income. Expanding seating or improving hospitality areas can boost revenue, but these initiatives require substantial investment, careful planning, and attention to fan experience to avoid disruptions to the atmosphere.

Season Tickets

Season tickets provide reliable revenue and build fan loyalty but limit income due to discounted pricing and underutilized seats. Many season ticket holders are unable to attend several matches each season, leading to empty seats and missed opportunities. While top clubs can resell empty seats, inefficiencies in resale systems lead to missed revenue. Additionally, vacant seats negatively affect matchday atmosphere, television viewership, and sponsorship activation, as well.

Operational Inefficiencies

Operational inefficiencies also hinder matchday revenue. Long queues, slow concessions, and outdated ticketing systems can create a poor fan experience, which in turn could reduce per capita spending. Issues like inadequate crowd management and limited payment options also discourage in-stadium purchases. Investing in digital ticketing, contactless payments, and improved logistics can streamline operations and enhance revenue.

Underutilized Stadiums

Outside matchdays, most stadiums are underutilized, missing opportunities for additional revenue. While some clubs host concerts and events, many lack the infrastructure (e.g., adaptable seating, AV systems) to fully capitalize on these activities. An initiative-taking approach and investment in flexible infrastructure could turn stadiums into year-round revenue generators.

Strategies to overcome these challenges

Dynamic pricing – Valencia CF

Valencia CF introduced dynamic pricing for the 2024/25 season, moving away from traditional ticketing models. Prices start low but can increase based on match demand, stadium occupancy, and game significance, rewarding early buyers with better prices and seats. This approach aims to increase revenue, which is particularly helpful in the current financial plight of the club. However, the programme has faced backlash from fans who argued that it undermined loyalty by creating price inequalities.

Despite the pushback, Valencia believes dynamic pricing will improve financial stability. Challenges remain, particularly in international competitions where price caps exist for away fans. Across Europe, clubs continue exploring how to balance fan loyalty with revenue generation.

In contrast, the Premier League, with its structured approach and strong fan engagement requirements, has largely avoided dynamic pricing. Clubs are required to publish ticket prices before the season, and around 70% of tickets are sold as season tickets that are exempt from price fluctuations (during the season). However, 2024/25 saw 19 of 20 Premier League clubs raise ticket prices, sparking protests from fan groups.

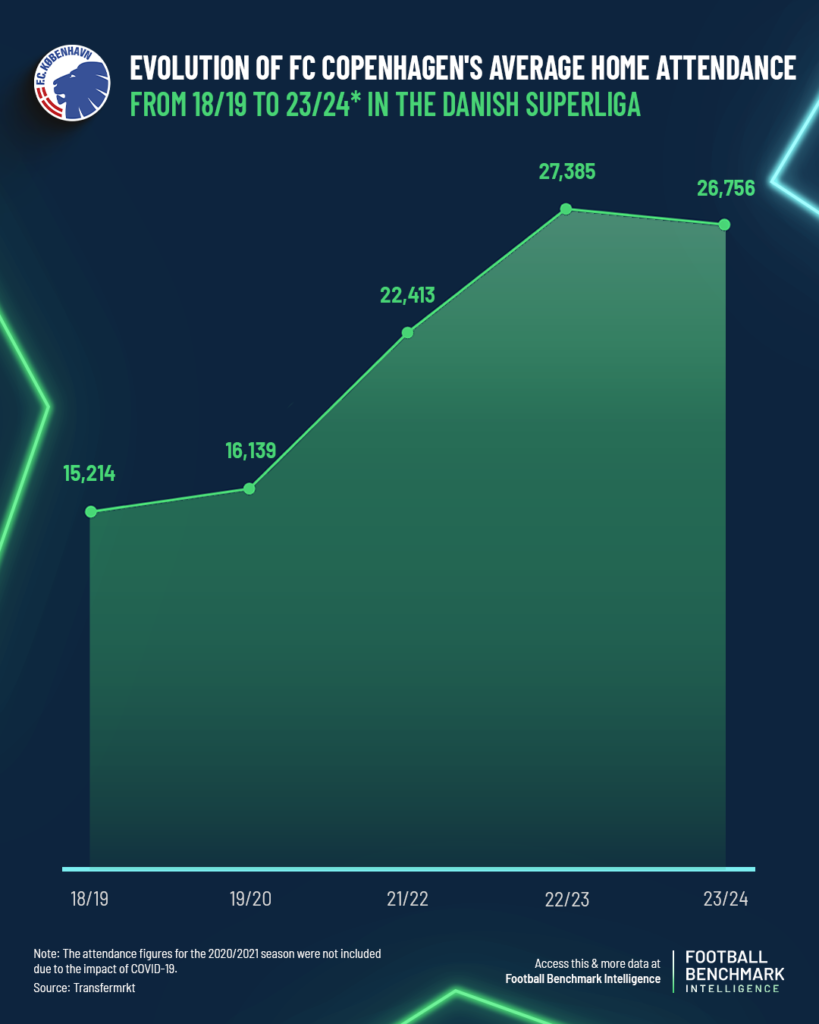

Subscription-based ticketing – FC Copenhagen

FC Copenhagen’s subscription-based ticketing model has revolutionized fan loyalty and revenue. By allowing season ticket holders to pay via subscription, the club moved away from traditional upfront payments, addressing the challenge of high initial costs that deter younger fans, particularly those in the 15-24 age bracket.

On top of offering priority access to tickets, the FCK+ subscription includes additional benefits such as match streaming, exclusive club content, and access to European qualification home ties, for which the club secured streaming rights in 2024. This shift has improved cash flow, eliminated the need for renewal campaigns, and ensured a steadily growing fan base. Supporters can transfer or return tickets via the club’s app, with funds credited to their accounts if the tickets are resold. As a result, average home attendance has risen from around 15,000 to nearly 27,000, demonstrating the model’s success in boosting engagement and financial stability.

The Danish national football team has also embraced the subscription model. In 2021, the DBU launched the ‘ForDanmark’ subscription, offering priority access to tickets. Fans can also secure a fixed seat for all national team matches through the ‘Dynamit’ subscription. This has contributed to near sell-outs for all home matches, for friendlies and competitive clashes alike.

Minimum attendance requirements – RB Leipzig

RB Leipzig have recently had to tackle the issue of no-show season ticket holders: nearly a quarter was missing each match, leaving approximately 7,600 seats empty per game. Despite selling 32,000 season tickets for 2023/24, around 300 season ticket holders attended only one game—the high-profile clash against Bayern Munich.

To address this enduring problem, RB Leipzig implemented a policy in 2024/25 requiring season ticket holders to attend at least 10 of the club’s 17 home games in the Bundesliga to retain their privileges for the following season. Those failing to meet the threshold risk losing their season tickets, which incentivizes consistent attendance. The policy aligns with similar initiatives elsewhere, such as Brentford FC’s ‘Every Seat Counts’ campaign, which boosted matchday attendance by 400-500per game. If successful, this policy could set a precedent for other Bundesliga and European clubs.

Investing in modern stadium infrastructure – Personal Seat Licenses (PSL)

The Personal Seat License (PSL) system, originally developed in the United States, allows teams to generate upfront capital for stadium construction or renovation, reducing reliance on debt. This model, first seen in a similar form with the Dallas Cowboys (NFL) in 1969 through “stadium bonds,” became more widely adopted in the late 1980s and early 90s.

European giants Real Madrid CF and FC Barcelona have recently implemented this strategy to fund major stadium upgrades:

- Real Madrid: Sold 475 PSLs, raising €70 million.

- Barcelona: Sold 300 VIP seats, raising €100 million.

A PSL is a one-time payment granting the right to use a specific seat for a set period (typically 30 years). While it doesn’t guarantee a season ticket, holders can resell seats for commercial gain. Barcelona sold their 475 VIP seats in bulk to two Qatar- and UAE-based investment funds, allowing them to resell the seats over 30 years. Real Madrid, on the other hand, sold around 300 PSLs for approximately €230,000 each, granting buyers the right to resell or transfer licenses.

While successful for these elite clubs, the PSL model is largely applicable only to teams with massive global fan bases and high-demand stadiums. Its effectiveness depends on a club’s ability to attract wealthy buyers and maintain long-term commercial appeal. The success of this strategy in Spain could inspire other top European clubs, particularly those planning new stadiums, to consider PSLs as a financing option.

Digital innovation and fan-centric strategies – Cercle Brugge

Ahead of the 2024/25 season, Cercle Brugge implemented a new digital system to enhance their operations and improve the matchday experience of premium customers. This initiative is being rolled out in phases, starting with the digitization of internal processes such as ticketing, catering orders, and premium services management. By reducing the risk of human error and streamlining operations, the club aims to offer VIP and B2B hospitality to customers with greater flexibility and control.

Through this new platform, fans can customize tickets and manage catering orders more efficiently, while the club gains valuable data insights to better understand supporter preferences and continuously refine their services.

Eliminating administrative inefficiencies allows Cercle Brugge to allocate more resources to strategic initiatives, such as expanding premium offerings, increasing fan engagement, and boosting revenue through higher seat occupancy and ticket sales. This modernization effort is positioning the club for long-term growth and success.

Maximizing stadium potential

Major European clubs are redefining their stadiums as multi-purpose entertainment hubs to boost revenue beyond matchdays. Tottenham Hotspur FC have made their venue a destination for NFL games, boxing, rugby, and major concerts, while also offering unique experiences like F1-inspired karting and a street-food market. Manchester City FC are expanding the Etihad Stadium with a fan zone, hotel, museum, sky bar, and stadium roof walk, alongside their investment in Co-op Live, the UK’s largest indoor arena. In Spain, Real Madrid’s £1.5 billion Santiago Bernabéu revamp and Barcelona’s Espai Barça project aim to transform their stadiums into premier entertainment venues, hosting concerts, NFL games, and large-scale events. By embracing this model, clubs are turning stadiums into year-round revenue generators, merging sports with the broader entertainment industry.

Stadium Business – Strategies to optimize matchday revenues

For decades, matchday revenue has been a cornerstone of football club finances, alongside broadcasting and commercial income. However, new fan engagement trends and technological advancements are challenging traditional ticketing models. Clubs must now adapt to a rapidly changing landscape where fan expectations, digital innovation, and commercial pressures require a more dynamic, data-driven approach to stadium monetization. In this article, we explore some of the strategies football clubs are implementing to maximize their matchday revenues. Defining matchday revenues Before the analysis, it is

The new Champions League on Sky: between technology, excitement and an increasingly engaging narrative

Since the 2024-2025 season, European soccer has changed its face with the new cup format, a revolution involving the Champions League,Europa League and Conference League. A total of 51 evenings, over 500 games and more than 342 competitions, with unprecedented coverage. Sky and NOW have secured the exclusive broadcast of 185 out of 203 Champions League matches, bringing audiences to the center of an increasingly immersive experience, on and off the field. But soccer reporting today is no longer just about

Premier League’s Green Revolution: ESG, Innovation and Passion for Football

During an engaging panel organized by SFS24, industry experts and managers examined the crucial role of sustainability in soccer, focusing on how Premier League clubs are adopting environmental, social and governance (ESG) strategies to innovate and transform their operating model. The panel featured prominent figures such as Tom Harris, Sustainability Manager Brighton & Hove Albion FC; Chris Goodwin, ESG Manager Chelsea FC; Caroline Carlin, Head of Clients and Sustainability Enovation Consulting; and Kelsey Francis, Senior ESG Reporting and Communications Manager also

SFS SNACK BRUSSELS – Football and Europe: rules, rights and priority

In the prestigious setting of the European Parliament, a symbolic venue for decisions that shape the future of Europe, on 26 March from 16.30 to 18.30 the SFS Snack Brussels, entitled "Football and Europe: rules, rights and priority",presents itself as a key event for debating the governance of European football. At a time of profound regulatory transformations and global challenges, this event offers a unique opportunity to bring together institutions, experts, and key industry players to outline effective strategies for

Game changers: a snapshot of the top 100 most valuable players

Following the conclusion of the winter transfer window, the latest update of the Football Benchmark Player Valuation Tool has reassessed the market value of over 10,000 players worldwide. This powerful tool, designed for clubs, agents and football governing bodies, provides an objective, data-driven valuation based on key factors such as performance metrics, contract details, age, and broader market trends. It is important to note that a player's market valuation reflects the estimated worth of their current contracts rather than a

EA FC FUTURES joins Bundesliga Common Ground in creating more opportunities to play around the world

This article is available in its original and unabridged version on the official Bundesliga website. The Bundesliga and EA SPORTS have joined forces as part of EA SPORTS FC FUTURES initiative, making the most of the established Bundesliga Common Ground pitches to provide further benefit to local communities around the world. This partnership project aims to promote the revamp and continued utilisation of 4 community pitches located around the world. Starting with the sites in Brazil, Nigeria, Indonesia and Germany, each pitch

Football from a global perspective: strategies, challenges and opportunities of the new digital era

Football is undergoing an unprecedented transformation, extending into new markets and reaching fans around the world. In the SFS panel'Globalization of football: how football is expanding into new markets,' industry experts discussed the strategies, challenges and opportunities that are driving the globalization of the game. Speaking on stage, moderated by Didem Dilmen , Director Of Communications Comparisonator, were Carolina Tha, Country Manager ITA, ES, PT and CH SambaDigital, Lucas Bugter, Director of Business Development 433 and Nicole Pike,

Ref House, Refereeing 4.0: From SFS22 to the New Rules of the Game

Giuseppe Totaro and Rasoul Abdulzahra are two referees ready to revolutionize one of the most controversial categories, often at the center of debates and headlines in major media. We at SFS know them well: they were awarded during the 2022 startup competition when their creativity and innovative vision already stood out. Today, the spotlight is on them again, thanks to Ref House, an ambitious project now close to its big launch. We reached out to Giuseppe, who gave us an

“Football. But French”: The Ligue 1 Rebranding and the Challenge of Sporting Identity

French football has decided to change its look. With the launch of the "Football. But French." campaign, Ligue 1 has embarked on an ambitious rebranding operation aimed at redefining its positioning in the international football landscape. This is not just a new visual identity—it is a cultural statement. French football seeks to be distinctive, elegant, and authentic, without following the narratives set by other top European leagues. The New Visual Language of Ligue 1 One of the most striking changes is the

Breaking down the record-high expenditure in the winter transfer window

After a summer window that saw a 10% drop in spending, the winter window increased by 8% compared to last season, reaching EUR 1.46 billion. As a result, the total transfer expenditure (summer + winter windows) across top-division UEFA leagues and the English Championship shows a 4% overall drop compared to last season reaching EUR 7.87 bn in 2024/25. This represents a slight decline in expenditure for the first time since the pandemic. With the transfer window now closed for