Analysis by Football Benchmark

With USD 1.25 billion allocated through prize money and solidarity payments, the expanded FIFA Club World Cup offers a practical example of how global competitions are influencing club revenues and shifting the financial landscape across regions and tiers of the game. While the highest earners were familiar names, the data reveals a more nuanced picture. European clubs from outside the “Big Five” leagues, as well as those with lower annual revenues globally, experienced significant financial impacts relative to their size. At the same time, the tournament’s access list and distribution mechanism enabled participating clubs to generate substantial new revenue, a dynamic that may influence competitive balance within domestic leagues around the world. This analysis examines how prize money was distributed, the amount individual clubs earned, and how these earnings compare to each club’s usual financial environment, highlighting both the scale and strategic implications of football’s newest global event.

How prize money was shared across participating clubs

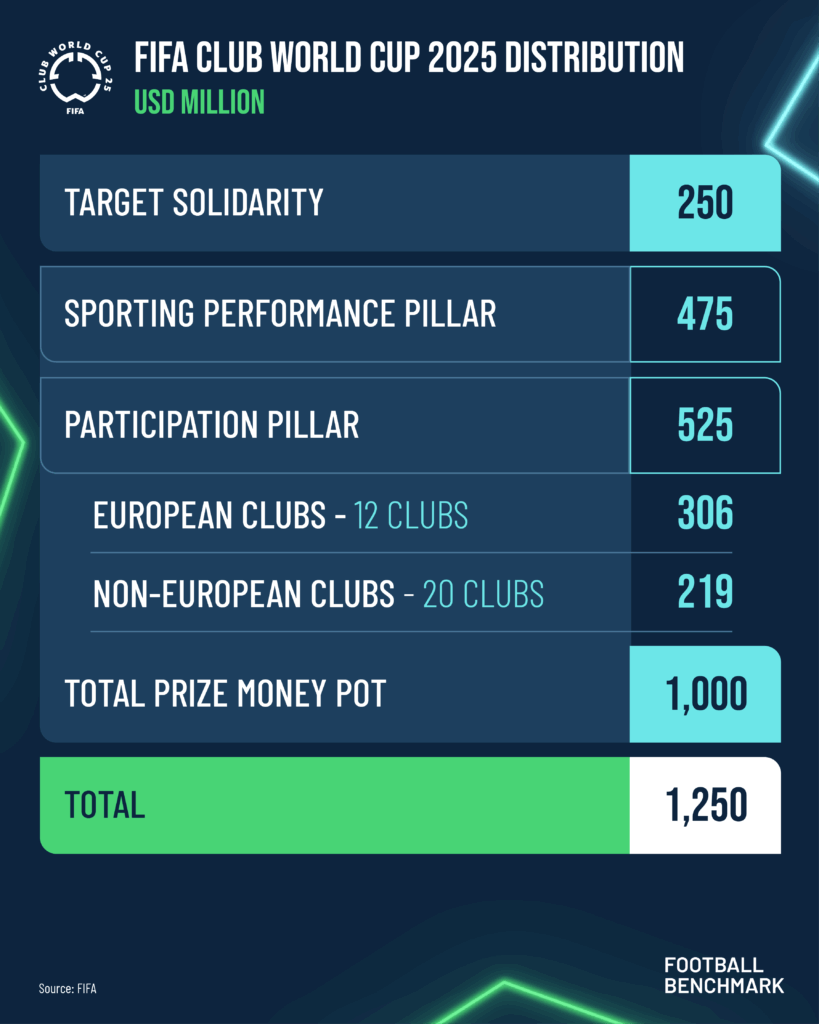

The USD 1 billion prize pot was divided across two pillars (a participation pillar and a sporting performance pillar) with an additional USD 250 million in solidarity payments to non-participating clubs around the world.

The participation pillar accounted for USD 525 million, with the remaining USD 475 million allocated based on sporting results. European clubs (12 participants) received an estimated USD 306 million from the participation pillar, with non-European clubs (20 participants) sharing the remaining USD 219 million. The tournament’s prize money distributions were underpinned in part by FIFA’s global media rights agreement, where DAZN reportedly paid approximately USD 1 billion to secure exclusive global broadcast rights. While the solidarity payment, a target of USD 250 million, was a one-off tied to a single tournament, the amount stands out in context. For reference, UEFA expects to distribute EUR 308 million (around USD 360 million) per year in solidarity payments to non-participating clubs over the 2024-2027 cycle.

Winners Chelsea topped the earnings list with an estimated USD 114.7 million, a particularly significant sum given that the club’s revenues were negatively impacted by the missed participation to the UEFA Champions League in the 2024-25 season. In addition, in the context of recently imposed UEFA sanctions on the club, the prize money provides a timely financial boost. Paris Saint-Germain followed closely with USD 107 million, ahead of Real Madrid (USD 82.5 million) and Fluminense, the highest-earning non-European club, at USD 60.8 million.

For clubs exiting in the group stage, the tournament still delivered meaningful returns. Urawa Red Diamonds, Ulsan HD, Wydad AC, CF Pachuca, and Seattle Sounders FC each earned USD 9.6 million, while Auckland City FC received USD 4.6 million. These amounts remain substantial compared to many domestic and continental rewards. While European clubs dominate the top end of the distribution, the tournament created financial uplift across all confederations. For example, the minimum payout to African participants was more than double the top prize available in the CAF Champions League, while in Concacaf, it comfortably surpassed the USD 5 million ceiling of the region’s Champions Cup. The Club World Cup’s expanded format has, therefore, opened a new tier of financial opportunity for clubs worldwide.

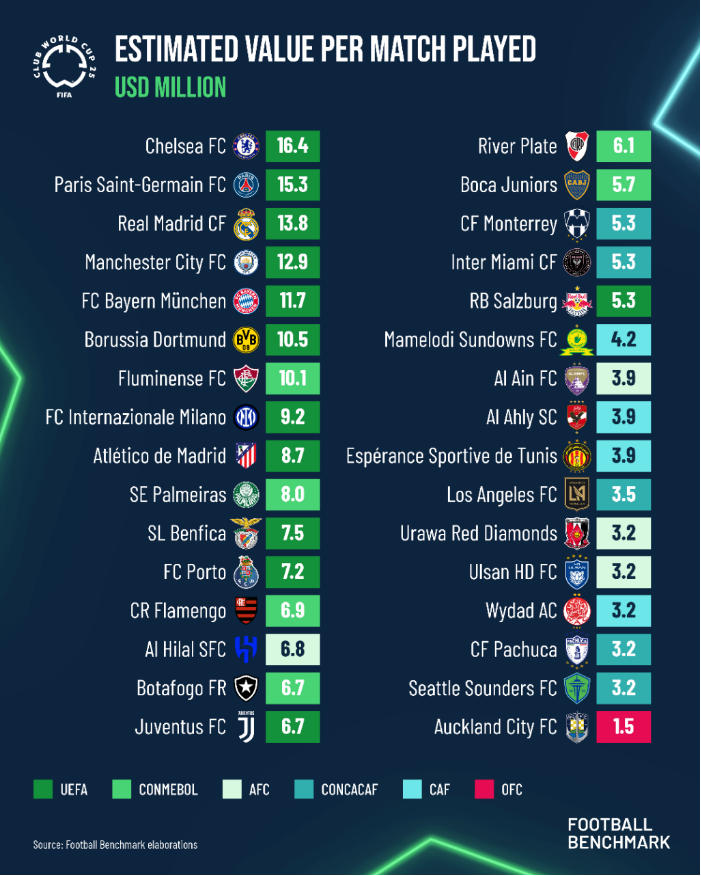

When assessing the tournament on a per-match basis, Chelsea earned an estimated USD 16.4 million per game, followed by Paris Saint-Germain at USD 15.3 million and Real Madrid at USD 13.8 million. For context, PSG’s average per-match earnings from their triumphant 2024/25 UEFA Champions League campaign were around USD 10 million, significantly lower than their equivalent earnings per match at the FIFA Club World Cup, despite finishing runners-up. While the UEFA Champions League still delivers the highest overall returns across a season, the Club World Cup ranks strongly in per-match value, particularly for clubs reaching the final stages.

Returns across AFC, CAF, and Concacaf clubs were more levelled, with most earning between USD 3-4 million per game, figures that remain significant in their local contexts. Mamelodi Sundowns FC, for example, earned an estimated USD 4.2 million per match, exceeding the aforementioned total prize awarded to the winner of CAF’s elite club competition. At the lower end, Auckland City FC received an estimated USD 1.5 million per match, remarkably close to the USD 1.7 million per-match value earned by Chelsea for winning the 2025 UEFA Conference League.

Evaluating the impact on club finances

The significance of prize money for participating clubs becomes clearer when viewed in relation to each club’s most recent annual revenues. For the vast majority of European and South American clubs, estimated earnings from the tournament account for between 5% and 15% of their latest available operating revenues. While notable, this represents a limited, recurring impact, given that it is a one-time income stream that occurs only once every four years. Chelsea and Fluminense stand out as exceptions, with prize money equivalent to approximately 18% and 73% of their latest annual revenues, respectively. Among European clubs outside the “Big Five” leagues, the share of FIFA Club World Cup income in relation to their most recent operating revenues ranges from 11% for FC Porto and RB Salzburg to 14% for SL Benfica. Focusing on the Portuguese clubs, SL Benfica and FC Porto earned an estimated USD 30 million and USD 22 million, respectively. These sums represent a significant boost relative to their typical revenue levels.

In Austria, RB Salzburg earned approximately USD 16 million, a figure that could help them in reinforcing their domestic advantage. Sturm Graz, who challenged for the league title and appeared to disrupt Salzburg’s long-standing domestic dominance, were not present. The financial return Salzburg collected from the tournament could widen the gap once more, despite Sturm Graz’s recent on-pitch progress. By contrast, for clubs from other confederations, particularly OFC, CAF, and partially AFC, the relative impact of the prize money can be far more significant. The most extreme example is Auckland City FC, whose USD 4.6 million payout is nearly eight times their most recently reported revenue of approximately USD 0.6 million. Similarly, African clubs such as Mamelodi Sundowns FC and Wydad AC may see their revenues nearly double as a result of their participation.

This comparison reveals that, while the absolute figures often favour elite clubs, the relative financial impact is most profound for those with smaller revenue bases. For such clubs, even a single appearance in the tournament can meaningfully influence financial planning and investment strategies.

The financial legacy of the 2025 tournament

The 2025 FIFA Club World Cup is injecting unprecedented revenue into clubs across a wide spectrum of markets. For some, it represented a strategic boost in a financially challenging season; for others, it was a transformative event that far exceeded their usual revenue base. But while these short-term effects are significant, the tournament’s long-term legacy will depend on whether it can drive broader, systemic development in the global club game. Many participating clubs operate in domestic environments that lack strong football economies, where limited media rights, commercial depth, or structural investment constrain sustainable growth. For these markets, global exposure alone is not a guarantee of progress. The real opportunity lies in whether the Club World Cup can help elevate the relevance and value of regional competitions, turning qualification into a strategic goal that drives investment, improves competitiveness, and ultimately strengthens the foundation of club football in each region. Crucially, this will also depend on how the tournament manages the challenge of integrating clubs from vastly different realities, not just in terms of quality, but also commercial infrastructure and domestic context. This is not a challenge unique to FIFA. UEFA faces a similar dynamic in the distribution of Champions League revenues, where large prize money inflows may also distort the reality of second- and third-tier markets. Both models must navigate the same underlying issue: how to deliver global value while protecting the integrity and development of domestic ecosystems.

The Club World Cup now sits at the intersection of global ambition and local fragility. Its long-term success will hinge on strategic alignment, ensuring that the financial excitement it generates is channelled back into the regions, competitions, and structures that make up the broader football pyramid. The Club World Cup has opened a new financial chapter in global football. Whether it becomes a catalyst for systemic development or a symbol of further polarisation will depend on the choices made from here.

FIFA Club World Cup 2025: Breaking down the billion-dollar prize money and its impact on clubs

Analysis by Football Benchmark With USD 1.25 billion allocated through prize money and solidarity payments, the expanded FIFA Club World Cup offers a practical example of how global competitions are influencing club revenues and shifting the financial landscape across regions and tiers of the game. While the highest earners were familiar names, the data reveals a more nuanced picture. European clubs from outside the “Big Five” leagues, as well as those with lower annual revenues globally, experienced significant financial impacts relative

Fan Experience, AI and Innovation: Adobe, Partner of the Social Football Summit, Alongside the Premier League

Adobe and the Premier League: Creativity and AI for a New Global Fan Experience The Premier League has announced a new multi-year partnership with Adobe, aimed at redefining the digital experience for fans around the world. Through the integration of advanced technologies such as generative artificial intelligence and real-time data management solutions, the League seeks to offer increasingly customized, dynamic, and creative engagement. At the heart of this transformation are Adobe Firefly and Adobe Express, tools that will allow fans to

SFS: the 8th edition heads to Allianz Stadium in Turin

The 8th edition of the SFS will take place on November 18–19, 2025, at the prestigious Allianz Stadium in Turin, marking an exciting new chapter for the international benchmark event in the football industry. A symbolic venue for an edition that promises to be even more innovative, sustainable, and engaging, with a dynamic program of thematic panels, workshops, startup competitions, and awards ceremonies. The goal? To explore and shape the future of football through technological innovation, digital transformation, sustainability, inclusion, and

LND and SFS: discussion on the topic of sports and human rights with regional representatives of LND’s CSR Area

Professor Marianna Pavan of Manchester Metropolitan University will also speak. A time for discussion to take stock of a season marked by social and inclusion projects that the Amateur League's CSR Area has promoted in synergy with its regional CSR contacts. On Monday, July 7 and Tuesday, July 8, at the"Carlo Tavecchio Room" at the LND headquarters in Rome, a meeting is scheduled to network through a shared daily commitment to sport and its function as a tool for guaranteeing human

Soccer between human intuition and artificial intelligence: comparing visions in meeting sponsored by LEAP Sport Academy

Speaking on July 18 in Lucca will be Federico Cherubini, CEO of Parma, coach Alessio Dionisi, Carlalberto Ludi, Sporting Director of Como, Pasquale Sensibile, Coordinator Scouting Team of Paris Saint-Germain, Gianfilippo Valentini, Founder of Social Football Summit and Manuel Vellutini, CEO of Akeron The world of soccer is increasingly influenced by data analytics, but what will be the future of soccer marketing? Can human intuition and algorithms be reconciled? These and other questions will be tried to be answered at a

Football on YouTube: La Liga Leads in Subscribers, but the Premier League Remains the King of Views

SFS in partnership with BuzzMyVideos The year 2025 has definitively marked football’s full entry into the era of digital maturity. YouTube has become the main playing field for clubs and leagues around the globe — a vast arena where success is no longer measured only in trophies, but also in views, subscribers and editorial strategy. In this evolving scenario, the numbers are clear: while the Premier League remains the undisputed leader in total views, the real breakout star of the year is Spain, with La Liga exploding

“The Football Biz Formula”: a new video podcast series exploring innovation in football and sports business

In partnership with BuzzMyVideos, SFS is proud to launch a brand-new editorial project: The Football Biz Formula. A video podcast series designed to spark informal yet insightful conversations around the innovation driving the future of the sports and football industry. Hosted by Paola Marinone, Founder of BuzzMyVideos, the show will feature high-profile guests sharing their perspectives, experiences and visions aligned with the mission of SFS - Social Football Summit: shaping the future of football, today. 📺 The podcast will be available on YouTube.🎙️ Stay tuned — The Future of Football

AS Roma and Ogyre partner up to collect 30,000 kg of plastic from the ocean

AS Roma is stepping onto the field alongside Ogyre, an Italian startup committed to protecting the Ocean, with a shared goal: removing 30,000 kilograms of marine litter and making a tangible contribution to environmental protection. This new collaboration stems from the desire to unite sport and sustainability, transforming the passion for football into a concrete act in support of the Planet. Thanks to Ogyre and its international network of fishers who collect marine waste daily in Italy, Indonesia, and Brazil, each

Sports Diplomacy and Soft Power: The FIFA Club World Cup as a Global Platform

Article written by Carlo Rombolà What does diplomacy have to do with sports—football in particular? A lot, especially at the highest levels. It is well known that major sporting events are opportunities for meetings, networking, and business. However, this has always been limited to the individual sphere, related to business and private relationships. But what if this concept were applied to nations instead of just businesspeople? In an increasingly interconnected world, sport has gradually taken on a central role in international diplomatic dynamics. Football,

YouTube and the Premier League: Turning Wins into Views

This is the first article in a reporting and analysis series on the YouTube performance of football properties, created in collaboration between SFS and BuzzMyVideos. In the first five months of 2025, the digital activity of Premier League clubs on YouTube has shown dynamics strongly influenced by sporting performances and seasonal events, with May confirming itself as a key month to understand the connection between on-field results and online visibility. At the top of the overall rankings is once again Liverpool, which has consistently led in both total views and new subscribers. In May alone, the Reds accounted for over 14%