Article written by Football Bnehcmark

RC Strasbourg is emerging as one of Ligue 1’s most ambitious projects under new ownership. BlueCo’s takeover in June 2023 marked a decisive turning point, placing the club within a multi-club ownership structure aimed at driving growth through targeted investment, talent integration, and shared expertise.

This transformation comes against a backdrop of fragility across French football. Ligue 1 continues to face structural financial challenges, with the value of broadcasting rights plateauing and questions lingering over the league’s broader appeal. Most clubs are operating below sustainable levels, recording a combined post-tax loss of €164 million in 2023/24.

Within this environment, Strasbourg’s approach under BlueCo stands out. After years of steady mid-table finishes since their return to Ligue 1 in 2017/18, the club is now pursuing a more ambitious trajectory, aiming to close the gap with the likes of Lille and Lens – the group of clubs that in recent seasons have challenged Marseille and Lyon’s place among the league’s top sides. Early signs of change are evident: rising expenditure, a strengthened squad, and growing integration with Chelsea. Strasbourg’s evolution has quickly become a test case for whether the MCO model can accelerate competitiveness and long-term sustainability in a league under financial strain.

This case study examines how Strasbourg’s integration into BlueCo’s multi-club model is reshaping the club’s financial profile, sporting performance, and position within the wider Ligue 1 landscape.

Financial evolution under new ownership

From a financial perspective, Strasbourg’s trajectory illustrates the transition from stability to investment under BlueCo. After several seasons of controlled spending and steady revenue streams, the club’s accounts now reflect the ambition of a project entering an expansion phase. The shift comes at a time when many Ligue 1 clubs are cutting back, showing how the new ownership is instead choosing to invest to strengthen the club’s position.

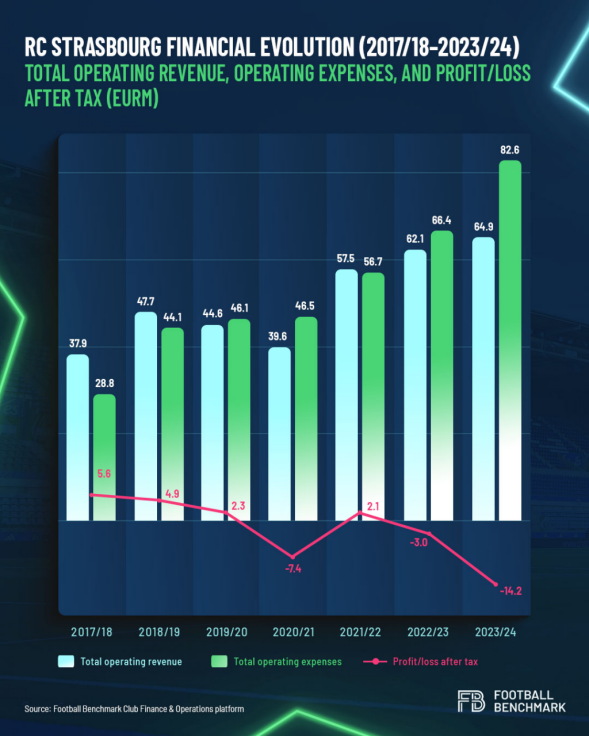

Between 2022/23 and 2023/24, revenues remained stable, but costs rose by 24%, leading to a sharp drop in profitability. The club posted a loss of €14.2 million after tax in 2023/24, a year on-year swing of 374%, marking a decisive break from the previous ownership’s conservative cost base. This downturn reflects deliberate, front-loaded investment in squad building and operational capacity aimed at accelerating growth.

Strasbourg has entered an investment cycle of short-term losses, driven by higher spending, which is expected to underpin longer-term value creation. The immediate outcome is reduced profitability, but the strategic intent is evident: to raise the club’s sporting ceiling and balance sheet strength through squad enhancement and participation in UEFA Club Competitions.

Squad development and competitiveness

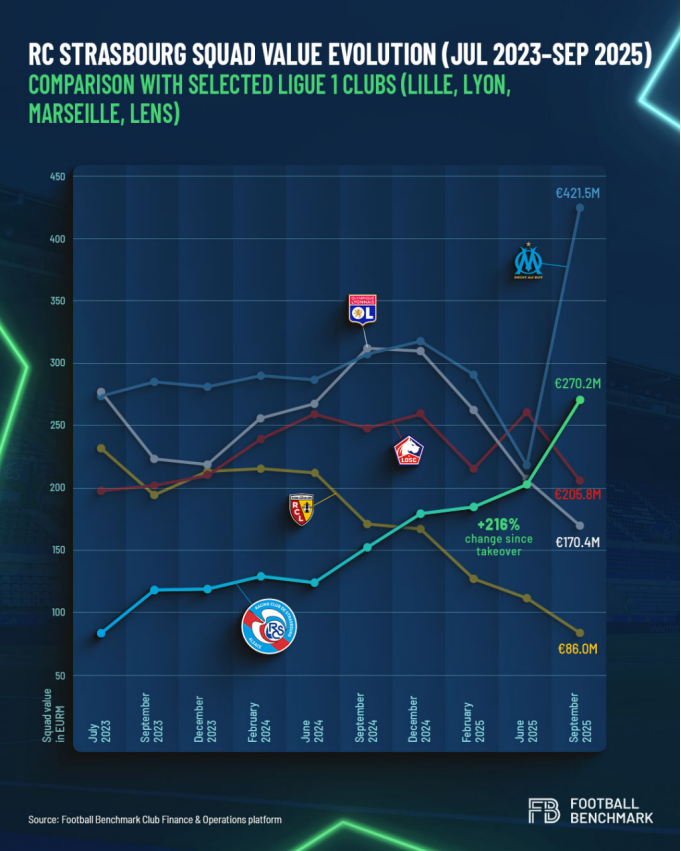

The financial investment seen since 2023/24 has already begun translating into on-pitch results, with improved competitiveness leading to qualification for the UEFA Conference League in 2024/25. This progress is reflected in the sharp rise in squad value, illustrating how sporting development is now mirroring the club’s broader financial and structural expansion.

Since the takeover in 2023, Strasbourg’s squad market value has increased by 216%, from €85.5 million to €270.2 million. This sharp rise contrasts with most comparable Ligue 1 clubs, where squad values have stagnated or declined, with the exception of Marseille (+54%). Lyon and Lens all recorded reductions over the same period, while Lille’s growth was far slower. In just two seasons, Strasbourg have closed much of the gap in squad quality, reflecting both the scale of investment and the influence of BlueCo’s multi-club ownership model.

A key driver of this progress has been the link with Chelsea. Since the acquisition, ten players have moved from Chelsea to Strasbourg – seven on loan and two on permanent deals, Diego Moreira (€8.5m) and Mathis Amougou (€14.5m). Among the most influential arrivals have been Djordje Petrovic, named the club’s player of the season in 2024/25, and Andrey Santos. Mamadou Sarr also joined Strasbourg in 2023/24 before transferring to Chelsea in the summer of 2025 for €14 million and immediately returning on loan. This summer, Ben Chilwell, an established Premier League and England international, joined Strasbourg as a free agent following the expiry of his contract at Chelsea, bringing top-level experience to the squad.

These player movements have strengthened the squad and raised Strasbourg’s competitive level, with participation in UEFA Club Competitions this season to bring additional revenue to support continued investment.

Bridging the gap with Ligue 1’s established clubs

As Strasbourg continue to grow under BlueCo, the question is how close they are to the next tier of Ligue 1 clubs and what still separates them from established competitors such as Lille, Lens, Marseille, and Lyon. While sporting progress has been visible, particularly through squad investment and European qualification, the financial and structural gap remains significant.

The data highlight the scale of the challenge. Strasbourg’s total operating revenue and staff costs are substantially lower than those of Lille, Lens, Marseille, and Lyon, reflecting their smaller commercial base and the early stage of their investment cycle. Profitability also remains negative, contrasting with the more stable financial profiles of Lille and Lens, which operate at sustainable levels supported by consistent European participation.

Off the pitch, the disparities are equally evident. Strasbourg have the smallest social media following among the group and a more limited stadium capacity, with utilisation levels below those of their peers. These indicators underscore the longer-term nature of building commercial scale and fan engagement. Planned redevelopment of the Stade de la Meinau will be crucial in this regard, providing the infrastructure required to increase matchday income and modernise the club’s facilities.

Overall, the figures underline a club in transition – one investing heavily to bridge financial and structural gaps while operating from a smaller base. The challenge now is to convert short-term investment and on-field competitiveness into recurring revenues and a stronger commercial platform capable of sustaining long-term growth.

Building long-term value through investment and integration

Strasbourg’s trajectory under BlueCo illustrates how France’s current football landscape, marked by financial fragility and declining media value, offers significant space for new investors to elevate ambitious clubs. In just two years, Strasbourg has shifted from stability to expansion, with greater spending power, a stronger squad, and deeper integration within the BlueCo network. These developments have yielded clear results, including European qualification and a 216% rise in squad value.

However, the project’s progress has not been without friction. While sporting results have improved, parts of the fanbase have expressed concern over the club’s autonomy and long term direction under multi-club ownership. These reactions underline the broader challenge of balancing performance-driven investment with local identity, particularly in traditional football markets like France.

Strasbourg’s evolution underscores both the potential and the limitations of the MCO model. The ability to share resources, talent, and expertise can accelerate competitiveness, but the path to financial self-sufficiency remains complex. As a relatively smaller brand operating in a strained domestic market, converting on-pitch progress into sustainable commercial growth will be the true test. In the French context, new ownership can elevate a club’s position within the hierarchy, but making that rise financially viable over the medium term remains far from guaranteed.

At Football Benchmark, we work with investors and clubs to identify and unlock long-term value across financial and sporting dimensions. Through our data-driven benchmarking, market intelligence, and strategic advisory, we support stakeholders in optimising investment strategies, including MCO structures, to achieve sustainable growth.

By Football Benchmark

BlueCo’s Strasbourg project: Investing to build a competitive force in a fragile Ligue 1

Article written by Football Bnehcmark RC Strasbourg is emerging as one of Ligue 1’s most ambitious projects under new ownership. BlueCo’s takeover in June 2023 marked a decisive turning point, placing the club within a multi-club ownership structure aimed at driving growth through targeted investment, talent integration, and shared expertise. This transformation comes against a backdrop of fragility across French football. Ligue 1 continues to face structural financial challenges, with the value of broadcasting rights plateauing and questions lingering over the league’s

Social Football Summit presents SFS 25: press conference in Milan on Monday, October 27th

The SFS officially kicks off the new edition with the SFS 25 Presentation Press Conference, scheduled for Monday, October 27, 2025 at 12 noon at the Lega Serie A headquarters, Via Ippolito Rossellini, 4 - Milan in the Assembly Hall. An appointment reserved for media and industry professionals to preview the news, themes and protagonists of the 2025 edition of the SFS, the reference event in Italy for innovation, sustainability and business in the world of soccer. The meeting will open withan

SFS and CDVM join forces to connect sports and marketing leaders

SFS is pleased to announce a new collaboration with CDVM – Club Dirigenti Vendite e Marketing, a long-standing association dedicated to professionals in sales and marketing. The agreement aims to strengthen the dialogue between the world of sports business and strategic marketing, fostering the exchange of experiences, expertise, and networking opportunities in the lead-up to SFS 25, scheduled for November 18–19, 2025, at the Allianz Stadium in Turin. Thanks to this partnership, CDVM members will benefit from special discounts for participation in the event and will actively contribute through the

Educational Excellence Meets Football Business: LEAP Academy at SFS 25 with the Master in Sports Law and Management

LEAP Academy will be a key player at the SFS 25, the benchmark event for Italian football business, which will take place at the Allianz Stadium in Turin on November 18th and 19th. The Academy will be featured at the event with a high-profile session: a conference titled "Working in the Sport Business," an integral part of its Master in Law, Justice, and Sports Management. This educational program was specifically designed by prominent figures in the football industry with a crucial

Linea Oro Sport takes the turf with SFS for a sustainable revolution

The SFS transcends the concept of a convention, establishing itself as a true catalyst for the creation of a more sustainable and cutting-edge football ecosystem, as outlined in its programmatic manifesto. To stimulate the evolution of the sector, a joint commitment is essential: from the integration of ethical and responsible practices to the strategic use of technology, up to the enhancement of an impact that does not end at the final whistle. It is with great satisfaction that we announce the

ExtraTime Innovation Tour: Rome City Institute hosts second leg

Yesterday morning, the second leg of the ExtraTime Innovation Tour of the SFS. Founded in 2018, the Rome City Institute in just a few years has become one of the most prestigious institutions of higher sports education in the world. Inspired by the U.S. model, it offers its international students the opportunity to attend different university courses by combining them with top-level sports practices. Stefano Radio, president of College Life Italia, did the honors by speaking about the importance

Boycotts and Sporting Sanctions: The Rules of International Sports Law

Article written by Carlo Rombolà “If a match cannot take place or cannot be played in full for reasons other than force majeure, but due to the behaviour of a team or behaviour for which an association or a club is liable, the association or the club will be sanctioned with a minimum fine of CHF 10,000. The match will either be forfeited or replayed. Additional disciplinary measures may be imposed.” — FIFA Disciplinary Code, Art. 16 — Unplayed Matches and Abandonment The

ESGeo Joins SFS as a New Partner

We are pleased to announce that Egeo, a leading company in sustainability and integrated ESG data management, is our new partner for SFS 25. The eighth edition of SFS will take place on November 18–19 at the Allianz Stadium in Turin. The event will serve as a key meeting point to discuss current and crucial topics: technological innovation, environmental sustainability, and business development in the world of football. With ESGeo alongside SFS, we will strengthen our offering with advanced expertise in how to develop a path geared towards value creation through: ESG strategies

Milan’s new stadium: Revenue potential, investment requirements, and the case for sharing

This article will answer the following three key questions: how much additional revenue could the new stadium generate, what level of investment will it require, and does it truly make sense for the two clubs to continue sharing a home? On 30 September 2025, the Milan City Council approved the sale of San Siro and its surrounding land to AC Milan and FC Internazionale, clearing the way for the stadium’s demolition and the construction of a new, shared home for the

YouGov confirmed as Partner of the 8th Edition of the SFS

The SFS is proud to announce that YouGov will once again be Partner of the 8th edition, taking place on November 18–19, 2025 at Allianz Stadium, Turin. YouGov, a global leader in data analytics and market research, has been an integral part of the Summit’s journey, contributing valuable insights on fan engagement, sponsorship evaluation, and market trends in football. YouGov’s proprietary panel of over 24 million respondents across 59 markets allows for a unique, data-driven understanding of how football evolves globally, and works across sectors such as media, sports, and consumer behavior helps clubs,